The New Zealand Tech Alliance is a group of independent technology associations from across New Zealand that work together to ensure a strong voice for technology.

Visit Tech Alliance

The New Zealand Tech Alliance is a group of independent technology associations from across New Zealand that work together to ensure a strong voice for technology.

Visit Tech Alliance

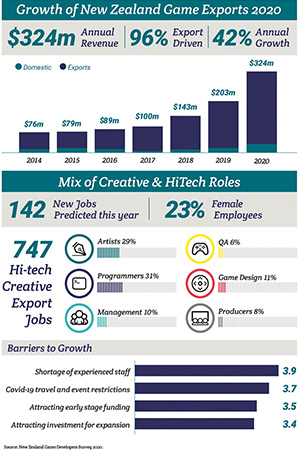

New Zealand’s video game developers have proven themselves resilient through Covid-19. Our interactive media sector earned $323.9 million in the year to 1 April 2020, an increase of $121 million in one year alone.

The industry benefited both from being able to continue production during lockdowns as well as soaring demand as people around the world stayed home and played digital and online games. 96% of local creators’ income came from overseas audiences.

The figures come from the annual New Zealand Game Developers Industry Survey of 42 interactive, gaming, virtual reality, augmented reality and education tech companies.

“Games and interactive media have given so many people the opportunity to come together when lockdowns and border closures have kept them apart,” says New Zealand Game Developers Association Chairperson Chelsea Rapp.

“The games industry has proven itself particularly resilient during the Covid-19 pandemic, both here in New Zealand and around the world. We are uniquely positioned to contribute to our economic recovery with weightless digital exports, but that growth will depend heavily on our ability to support young and emerging enterprises.”

The ten largest studios earned 95% of this revenue but are now 11 years old on average. However, 75% of studios employ five people or less and the Association is concerned by the lack of support to grow these firms to take advantage of the export opportunity.

Despite the survey being conducted in the middle of New Zealand’s second Covid-19 lockdown, 49% of studios surveyed predicted significant growth (10% or more) this coming year. Only 17% of studios predict any decline in sales.

While lockdowns have increased the market opportunity, travel restrictions have made it harder to make publishing deals and secure funding. The top four challenges studios reported facing were a shortage of experienced staff, Covid-19 travel restrictions, attracting early stage funding and attracting investment for expansion.

Last year’s Interactive Aotearoa report by the Game Developers Association recommended that the Government create an interactive innovation fund and industry development plan to grow the pipeline of new interactive firms. The Government is currently consulting on the Digital Technologies Industry Transformation Plan and the Screen Sector Strategy 2030, which these could be part of.

The New Zealand Game Developers Survey 2020 Highlights

The data comes from a survey of 42 New Zealand Game Developers Association studios conducted by independent researcher Tim Thorpe and is for the financial year ending 31 March 2020.

86% of studios say they are independent game developers who create their own IP, although 19% of those also make products for paying clients. 11% contract to other clients solely, while 3% create educational and serious games.

Interactive studios are spread around the country, with 40% in Auckland, 26% in Wellington, 14% in Otago, 10% in Canterbury, 5% in Waikato and 5% in Bay of Plenty.

96% of revenue was earned overseas, mostly by selling digital services to consumers via various digital platforms. 5% of revenue also came from royalties, 8% from selling advertising in games and 7% from selling services.

New Zealand studios target audiences around the world, with 65% reporting significant income from North America, 41% from Europe and 21% from Mainland China.

The industry employed 747 full time creative technologists, and expect to create another 142 new jobs this year. This is an increase of 9% from last year.

29% roles were for artists, 29% for programmers, 11% for game designers, 10% for management, 8% producers, 6% quality assurance, 2% audio and 1% writers.

23% of studio employees identified as female.

For the studios that reported skills shortages, 89% were seeking programmers, 33% 3D artists, 33% game designers, 15% 2D artists, 15% management, 11% producers, 4% quality assurance, 4% audio and 4% writers.

The sector attracts staff from a variety of sources. 48% of studios said they had hired staff directly from tertiary education in the last year, 48% from another game studio, 45% from overseas, 35% from other creative or tech companies.

111 employees, or 15% of the industry, are currently or have previously been on work supported visas.

61% of studios create games for PC, 48% for mobile devices, 36% for consoles, 27% for virtual reality, 18% for augmented reality and 24% for websites.

On average studios are 6 years old, with the oldest being 23 years old.

The top 10 studios employ 78% of the industry’s full time workers and account for 95% of revenue.